Case Study: Due Diligence

Winsome IP helped a Fortune 500 technology firm in evaluating the patent portfolio of an acquisition target operating in the domain of network security. The insights uncovered during the patent due diligence study provided significant value to our client while making critical business decisions.

Business Issue

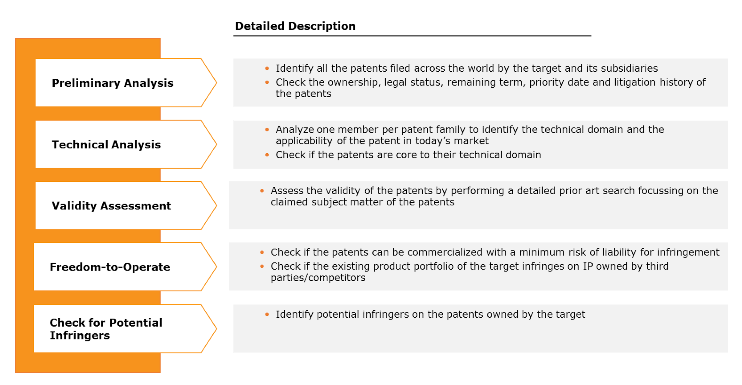

IP Due Diligence is a process of auditing the intangible assets of a company and uncovering risks/liabilities. The challenge faced by a company looking to acquire a patent portfolio is to perform a thorough evaluation of the patent portfolio in a defined interval of time so as to offer a competitive bid. Effective and efficient IP due diligence is becoming a driving factor to making a merger and acquisition (M&A) deal successful.

Other than the M&A deals, a company should go for IP due diligence in the following situations.

- A venture capitalist should assess the IP related strength and liabilities of a technology firm before making an investment.

- Before getting into a business partnership or cross-licensing agreements, a company should assess the strength and risks associated with the IP portfolio of a prospective partner.

- A company that wants to use

IP assets to obtain financial loans should perform an extensive due diligence on its IP portfolio.

“The team at Winsome IP diligently reviewed the patent portfolio and pointed out interesting facts proactively. Their value-add was an important factor behind going ahead with an acquisition that was very critical for our business”

– Counsel, Client

Impact

Some examples of the insights discovered during the due diligence are given below.

The patent portfolio was wholly owned by the target and there were only a handful of third parties operating in the exact same technical domain.

The target owned core patents in the domain of encryption. A set of key market players potentially infringing on the core patents was also identified.

Winsome IP strives to be a leader in providing value added services to a global clientele at every stage of patent lifecycle. We are a group of professionals having extensive techno-legal experience and expertise in IP creation, management and monetization. Our clientele includes law firms, technology corporations, start-ups, venture capitalists, patent brokerage firms and individual inventors. Through our services, we help our clients make smarter business decisions based on critical insights into IP opportunities.

Most of the core patents were active and had a lifespan of 7 years (average).